Cool Japan Fund provides funding and other supports for business activities that contribute to expand overseas demand of attractive products and services unique to Japanese lifestyle & culture. By proactively investing in projects that have high policy significance but high risk, in which it is difficult for the private sector to invest, we aim to convey Japan's attractiveness and brand to the world and create various ripple effects over the medium to long term.

- Specialized in Attractive Products and Services Unique to Japanese Lifestyle & Culture

- Overseas Investment / Overseas Expansion Support

- Portfolio Value Creation

- Credit and Network as a Governmental Fund

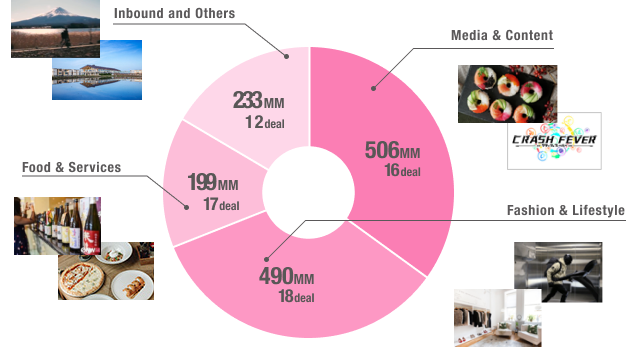

Track Record

- Investment

- USD1,114MM

- the Number of Investments:

- 72deals

Specialized in Attractive Products and Services Unique to Japanese Lifestyle & Culture

We focus on investing in businesses across these areas, such as content, food & clothing & housing related products, services, advanced technology, leisure, local products, traditional products, education, tourism, etc.

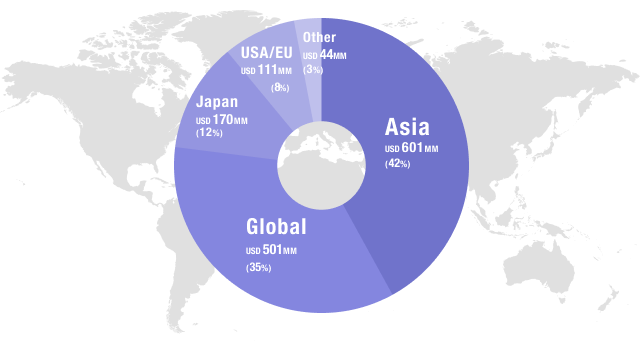

Overseas Investment / Overseas Expansion Support

We are dedicated to investing in businesses all over the world, including the Asian region where demand for Japanese products and services is increasing and Western countries emphasized from the point of view of branding strategies.

Portfolio Value Creation

We proactively support portfolio companies, with knowledgeable and deeply experienced experts. We definitely commit “Value Creation” with business matching, utilizing our network - other governmental organizations, local governments, companies, and advisory firms.

- PMI*Management

-

Accelerate PMI as PMO after implication with management.

- Establish the communication plan among the directors, the representatives of Value Creation and the team members.

- Establish reporting process.

- Support Value Creation initiatives for implementation.

- Revenue Growth

-

Support business matching - Introduce potential customers and suppliers to expand service lineup, EC service launch, digital transformation for BtoB business, co-promotion with portfolio companies and business partners etc.

ex. Introduce potential Japanese customers from our network, providing Japanese language support.

- Margin Improvement

-

Support digital transformation for, pricing optimization, cost management enhancement, enhance MRO procurement etc.

ex. Enhance S&OP – Sales and Operation planning - , encouraging the collaboration with sales and manufacturing departments to realize the best pricing and inventory optimization.

- BS Optimization

-

Enhance credibility for bank loan, optimize capital structure and enhance inventory management etc.

ex. Encourage the sales of slow moving inventory, enhancing inventory management process by SKU.

- Governance Enhancement

-

Support to establish a mid-term business plan and to enhance accounting management - consolidated financial statement & management reporting.

ex. Support to update business plan, reflecting the new business model amid COVID-19.

ex. Enhance account management, communicating with portfolio companies closely, dispatching HR resources such as Japanese accountant who can speak the local language for several months.

*Post Merger Integration : the process of post-M&A integration and the activities

Credit and Network as a Governmental Fund

We show the strength of our credibility as a governmental fund by harnessing information from networks with other governmental organizations in Japan and overseas, and with local governments and companies across the country.